Contents

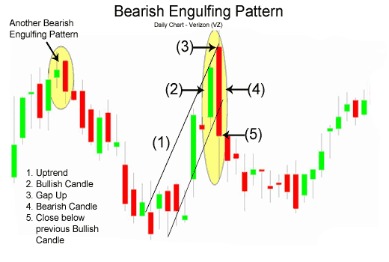

It enables investors and traders to identify price patterns. It is used in technical analysis to understand the current direction of the price movement of a security relative to the previous day, or any other set period. The VIX is the CBOE volatility index, a measure of the short-term volatility in the broader market, measured by the implied volatility of 30-day S&P 500 options contracts. The VIX generally rises when stocks fall, and declines when stocks rise. Also known as the «fear index,» the VIX can thus be a gauge of market sentiment, with higher values indicating greater volatility and greater fear among investors. Investors can find periods of high volatility to be distressing as prices can swing wildly or fall suddenly.

- Historical volatility uses the standard deviation of the log of the ratio of consecutive market closings over a defined period of time.

- Investing is a lifelong pursuit, and a well-balanced, diversified portfolio was designed specifically for times like these.

- The acquisition was finalized even as SM Entertainment accused Hybe staging a hostile takeover to control the firm by purchasing shares from Lee Soo-man, SM’s founder.

- At any given point in time, the intrinsic value is solely determined by the difference between the current price of the underlying and the strike price of the option.

- Escalation between the U.S. and China in 2018 is a good example of it.

If you are not afraid of some risk and you can afford a loss, higher volatility is an option. Sure, you put more on the line, but the rewards are greater as well. Younger investors seem to be more comfortable with high-volatility stocks since they have more time to rebound if their investments are not as profitable as anticipated. Volatility can assess risk, offering guidance to investors. It is not always a negative phenomenon since it also creates opportunities for the investor. Keep in mind that volatility is based as much on perception as on value.

Volatility measures how dramatically stock prices change, and it can influence when, where, and how you invest

It’s up for debate as to whether these ETFs consistently perform any better than the https://forexarticles.net/ as a whole. Still, they could be a valuable part of a broad investment portfolio, especially during times when the stock market is fluctuating wildly. To better grasp this concept, let’s examine these imaginary companies again, assuming that you make a one-time investment of $1,000. Watch how volatility affects the total amount of money you’ll have at the end of each year, based on the returns above.

Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative . A measurement of historic volatility looks at a security’s past market prices. Implied volatility is determined using the price of a market traded derivative.

So if you hopped out at the bottom and waited to get back in, your investments would have missed out on significant rebounds, and they might’ve never recovered the value they lost. That said, the implied volatility for the average stock is around 15%. So tread carefully anytime you see an asset with an IV over 20%. Variance is a measurement of the spread between numbers in a data set. Investors use the variance equation to evaluate a portfolio’s asset allocation. This means adding each value and then dividing it by the number of values.

Dhttps://bigbostrade.com/ersification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. Prepare by making sure your investments are diversified enough to withstand all the ups and downs the market is bound to throw at you. Volatility is not affected only by trade agreements, legislation, or elections. Rumors, illnesses and even speeches can cause stocks to plummet or soar, setting the market on its ear. It is critical to know that implied volatility is not scientific. It is based on projections and should be used as a guide rather than a forecast of future performance.

It also presents a higher risk when employing delta-neutral strategies because of the more volatile price movements. High implied volatility is good for an option seller because they can sell options with higher premiums. Above 50% is considered high enough to employ strategies that benefit from a drop in implied volatility. These strategies have negative vega, such as iron condors, credit spreads, and at-the-money butterflies.

Unfortunately, the Volatility Index 75 trades successful traders don’t execute almost all of their trades. Finally, calculate the Volatility 75 by multiplying the standard deviation by 100. Volatility trading can be a profitable way to make money in the markets. One advantage is that it doesn’t matter whether or not the market swings up or down. Divide 102 by 100, subtract 1, and multiply the result by 100 percent. Now let’s imagine that the price of the option drops to $100 the next day.

Great returns so far!

Another way of dealing with volatility is to find the maximum drawdown. The maximum drawdown is usually given by the largest historical loss for an asset, measured from peak to trough, during a specific time period. In other situations, it is possible to use options to make sure that an investment will not lose more than a certain amount. Some investors choose asset allocations with the highest historical return for a given maximum drawdown.

It can be scary to see large—or even small—losses on paper. But in the end, you must remember that market volatility is a typical part of investing, and the companies you invest in will respond to a crisis. Often,oil pricesalso drop as investors worry that global growth will slow. Traders searching for a safe haven bid up gold and Treasury notes. If the stock price varied widely in the past year, it is more volatile and riskier. You might have to hold onto it for a long time before the price returns to where you can sell it for a profit.

What is Market Volatility?

If you are in it for the long haul and you don’t plan on pulling your money out any time soon, consider investing the majority of your funds into low-volatility options. If your portfolio is to fund your retirement, you may be better off investing in proven securities with low volatility. Your profit will be less but your investment will be safer.

His primary interests at Investment U include personal finance, debt, tech stocks and more. Understanding that risk and volatility are not the same makes it much easier to manage both. Central banks like the Federal Reserve control a nation’s monetary policy. They change interest rates to stimulate or slow an economy as necessary. Forbes Advisor adheres to strict editorial integrity standards.

However, even if the https://forex-world.net/ fluctuations can reward, the factor of risk involved cannot be denied. Determine the difference between each price in the set and the average price. High values indicate that intraday prices have a wide high-to-low range. Low values indicate that intraday prices have relatively constant high-to-low range. Even with the market volatility, high inflation, and economic hardships during the second half of 2022, government employees saw the lowest rate of layoffs and discharges. Both CFDs and cryptocurrencies are complex leveraged instruments and carry a high level of risk.

The volatility of a stock can be seen as an indicator of fear or uncertainty. Prices tend to swing more wildly when investors are unable to make good sense of the economic news or corporate data coming out. An increase in overall volatility can thus be a predictor of a market downturn. Volatility is also a key component for pricing options contracts.

Consider Market Volatility an Opportunity

As a result, volatility measured with high resolution contains information that is not covered by low resolution volatility and vice versa. Actual historical volatility – measured over a specific period of time with the last observation date being in the past. The volatility of a financial instrument can be determined by a number of different ways, and there are different types that investors commonly analyze. A common method of calculating the relative volatility of a security to the market is its beta.

By watching and identifying stocks when they are low and doing your due diligence in tracking the volatility, you can trade for a profit. The Chicago Board Options Exchange created the CBOE Volatility Index, known as the VIX, as a way of drilling down further into the performance and volatility of S&P 500 Index options. Sometimes known as the “fear gauge,” the VIX Index measures the level of implied volatility of the S&P 500 Index over the next 30 days. This weighted mix of the prices of S&P 500 index options measures how much people are willing to pay to buy or sell the S&P 500. When they are willing to pay a higher price it means more uncertainty. When selecting a security for investment, traders look at its historical volatility to help determine the relative risk of a potential trade.

What changes in legislation could prompt changes in trading? Even if there are no elections or new officials, there could be changes in foreign or domestic policies that could leave investors unsure of what is to come and how they will be affected. A declaration of war between two countries, even if your own country is not involved, could affect trade and pricing . Since volatility is a measurement of uncertainty or fear, it is easy to understand why. So, although volatility develops for many reasons, it is important to note that even as little as a 1% deviation in the market can get it the label of volatile.

In addition, the typically negative correlation between VIX futures and options and the stock market has provided a natural hedge against stock and index market positions. The VIX is a weighted mix of the prices for a blend of S&P 500 Index options, from which implied volatility is derived. Implied volatility is the expected volatility of the underlying security. The VIX concentrates on the price volatility of the options markets, not the volatility of the index itself.

Volatility key takeaways

However, if it is sustained over a long period of time or if the fluctuation is sharp and indicates future changes, then the fluctuation crosses the line into volatility. When volatility is low, the VIX is low and when the market is more volatile, lifting the “fear” factor, the VIX is high. Investors plan to buy when the VIX is high and sell when it is low, but there are always other factors that they use to determine buy/sell tactics. The volatility of securities or portfolios in comparison to the market as a whole is measured by beta. Because most traders are most interested in losses, downside deviation is often used that only looks at the bottom half of the standard deviation.

Volatility, as expressed as a percentage coefficient within option-pricing formulas, arises from daily trading activities. How volatility is measured will affect the value of the coefficient used. This calculation may be based onintradaychanges, but often measures movements based on the change from one closing price to the next. Depending on the intended duration of the options trade, historical volatility can be measured in increments ranging anywhere from 10 to 180 trading days. Implied volatility , also known as projected volatility, is one of the most important metrics for options traders. As the name suggests, it allows them to make a determination of just how volatile the market will be going forward.